Overview

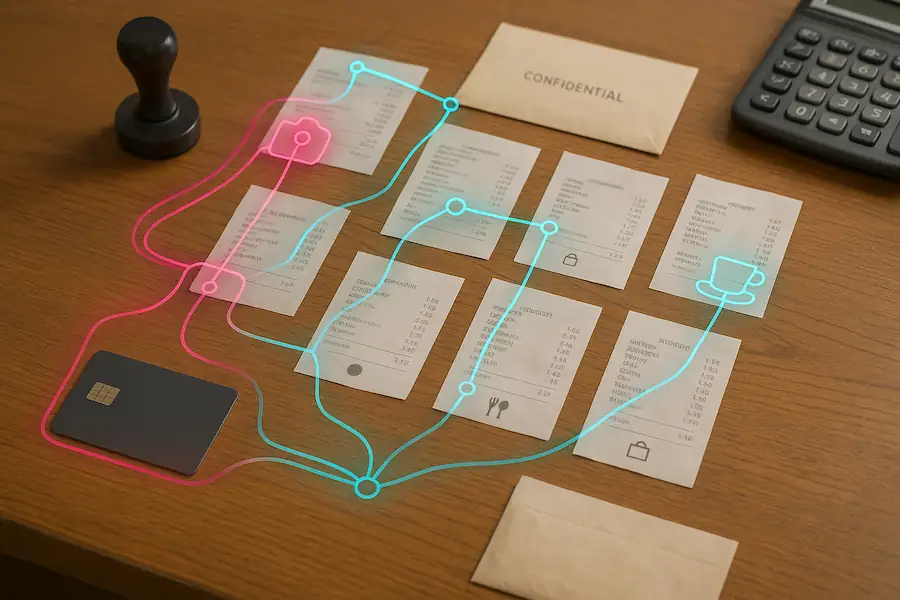

We worked with a university finance department to identify fraudulent corporate credit card transactions by building a bespoke, unsupervised pattern-discovery system that learns normal behaviour and flags meaningful deviations.

Problem

Periodic consultant reports and rule-based alerts were in place, yet a fraudster managed to bypass these controls for an extended period of time. The team needed a more accurate and timely way to detect suspicious activity.

Solution

- Unsupervised pattern discovery: Instead of pre-coded rules, the system learns the norm from cardholder data and surfaces deviations.

- Risk-based ranking: Cardholders are ranked according to the number and utility of deviating patterns identified in their transactions, helping analysts focus on the highest-risk profiles first.

Result

- The prosecuted fraudster ranked second, with all suspicious patterns correctly identified, which made the behaviour easy to spot.

- When run periodically, the tool provides peace of mind and early alerts to deviating patterns, enabling detection before significant losses occur.