Overview

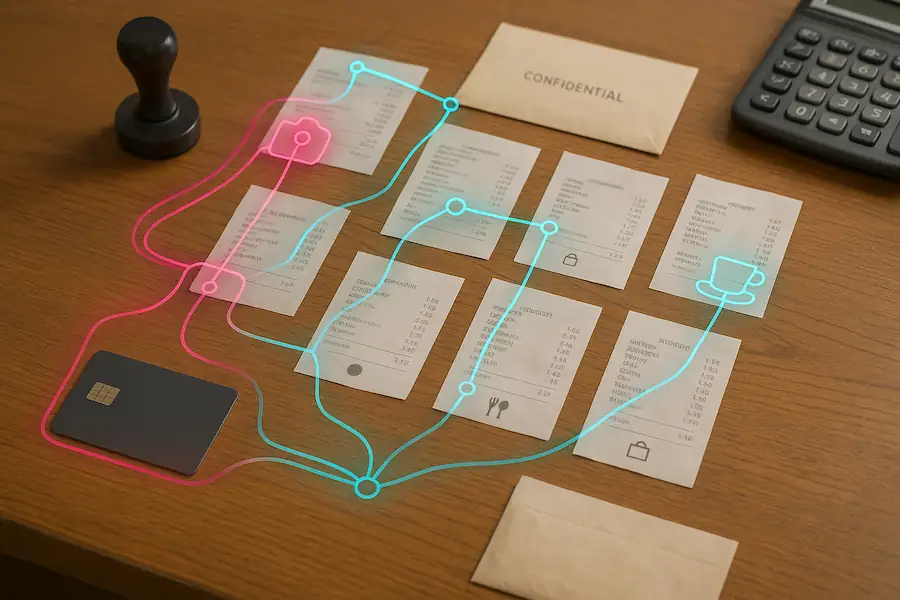

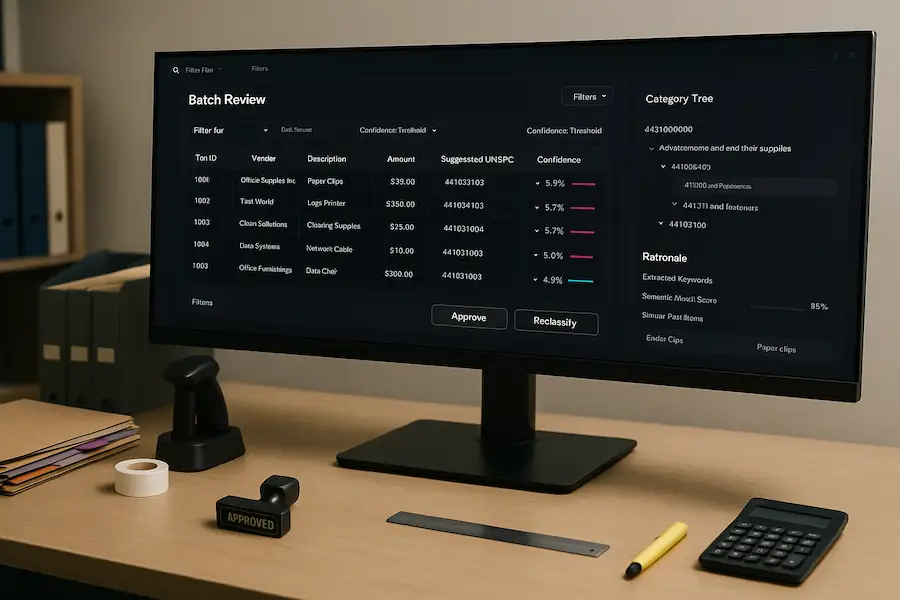

We worked with the Department of Finance to automate mapping expenses to United Nations Standard Products and Services Code (UNSPSC) with a bespoke machine learning model, delivering high-accuracy classifications and freeing teams from manual coding.

Problem

Analysts spent significant time reading expense descriptions and assigning precise UNSPSC codes. Existing manual processes slowed throughput and introduced inconsistency.

Solution

- Custom ML classifier: Automated categorisation of financial transactions to UNSPSC codes.

- Technique blend: Combined text processing, a custom learning mechanism, and semantic matching to improve coverage for future cases.

- Accuracy focus: Tailored to the department’s data to maximise precision.

Result

- Over 99% classification accuracy, a 15% uplift versus out-of-the-box machine learning techniques.

- Productivity and cost savings from automating a previously manual task.